Everything about Clark Wealth Partners

Table of ContentsThe Best Guide To Clark Wealth PartnersGetting The Clark Wealth Partners To WorkThe Best Guide To Clark Wealth PartnersClark Wealth Partners for DummiesSome Ideas on Clark Wealth Partners You Should KnowThe Buzz on Clark Wealth PartnersThe Best Guide To Clark Wealth Partners

The globe of finance is a challenging one. The FINRA Foundation's National Capacity Study, for example, just recently discovered that almost two-thirds of Americans were unable to pass a standard, five-question financial proficiency test that quizzed participants on topics such as rate of interest, financial obligation, and other reasonably basic principles. It's little marvel, then, that we often see headlines regreting the inadequate state of many Americans' funds (financial advisor st. louis).Along with handling their existing customers, financial experts will certainly commonly spend a fair amount of time every week meeting with possible customers and marketing their services to retain and expand their service. For those thinking about ending up being an economic advisor, it is essential to take into consideration the typical salary and work stability for those operating in the field.

Training courses in tax obligations, estate preparation, financial investments, and risk monitoring can be handy for trainees on this course as well. Depending upon your distinct job objectives, you might additionally require to gain particular licenses to fulfill specific clients' needs, such as getting and offering stocks, bonds, and insurance coverage. It can also be handy to earn a qualification such as a Certified Economic Organizer (CFP), Chartered Financial Expert (CFA), or Personal Financial Specialist (PFS).

Clark Wealth Partners Can Be Fun For Anyone

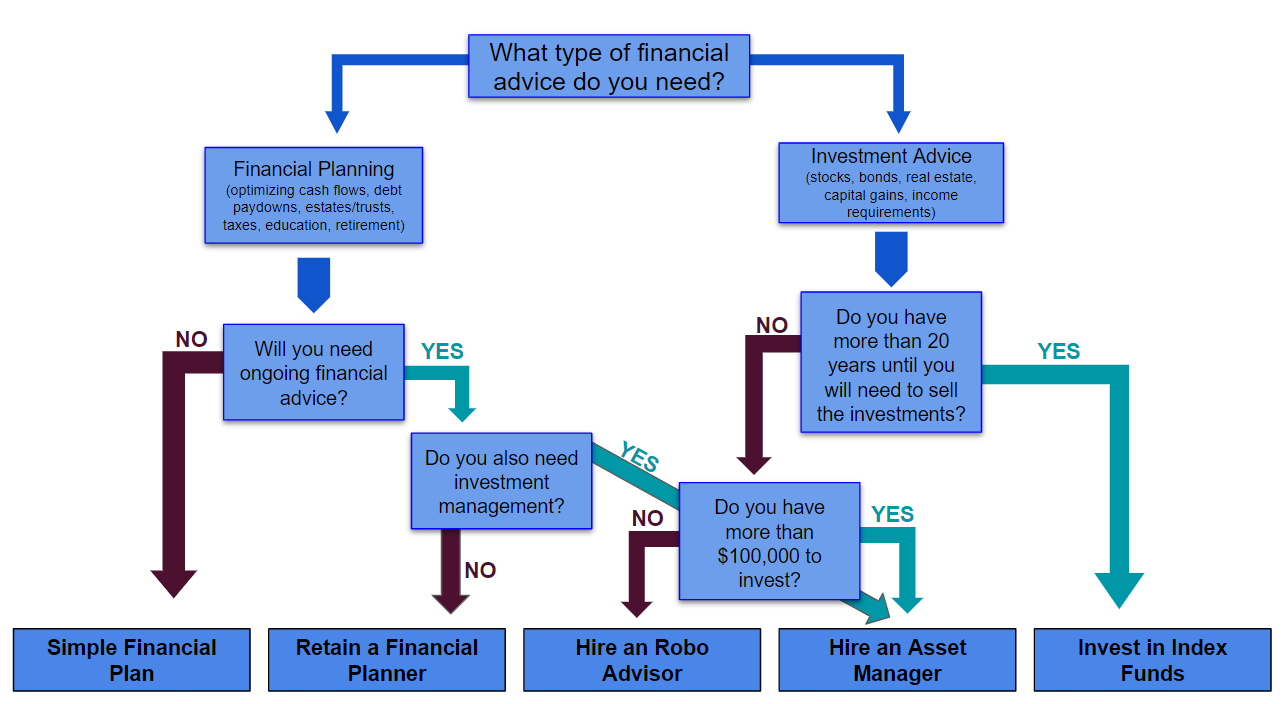

What that looks like can be a number of points, and can differ depending on your age and phase of life. Some people fret that they need a particular amount of cash to invest prior to they can obtain help from a specialist (civilian retirement planning).

The Basic Principles Of Clark Wealth Partners

If you have not had any experience with a financial consultant, right here's what to anticipate: They'll start by providing a thorough evaluation of where you stand with your possessions, liabilities and whether you're fulfilling criteria contrasted to your peers for savings and retirement. They'll examine short- and long-lasting objectives. What's useful regarding this action is that it is individualized for you.

You're young and working complete time, have an automobile or two and there are trainee finances to pay off.

Our Clark Wealth Partners Diaries

Then you can discuss the following best time for follow-up. Before you start, inquire about pricing. Financial advisors normally have different rates of prices. Some have minimum property levels and will charge a charge normally numerous thousand bucks for producing and adjusting a strategy, or they might charge a flat charge.

Constantly review the small print, and ensure your monetary advisor follows fiduciary standards. You're looking in advance to your retirement and assisting your youngsters with greater education and learning costs. An economic advisor can provide suggestions for those circumstances and more. The majority of retired life plans supply a set-it, forget-it option that allocates properties based on your life stage.

8 Simple Techniques For Clark Wealth Partners

That may not be the most effective way to keep building wide range, particularly as you progress in your job. Arrange regular check-ins with your coordinator to tweak your plan as needed. Stabilizing savings for retirement and university expenses for your youngsters can be challenging. A financial consultant can aid you prioritize.

Believing around when you can retire and what post-retirement years could look like can create concerns about whether your retirement financial savings are in line with your post-work strategies, or if you have actually conserved enough to leave a heritage. Assist your economic expert understand your approach to money. If you are much more traditional with saving (and potential loss), their suggestions should reply to your concerns and worries.

Clark Wealth Partners Can Be Fun For Anyone

For instance, preparing for healthcare is among the large unknowns in retired life, and an economic specialist can detail options and suggest whether added insurance policy as protection might be valuable. Before you begin, attempt to get comfortable with the concept of sharing your entire financial photo with a specialist.

Giving your specialist a full picture can help them produce a strategy that's prioritized click here for more info to all parts of your monetary status, especially as you're rapid approaching your post-work years. If your funds are straightforward and you have a love for doing it yourself, you might be great on your very own.

A financial consultant is not only for the super-rich; anybody facing major life transitions, nearing retirement, or feeling overwhelmed by economic choices might profit from specialist guidance. This short article checks out the role of monetary advisors, when you may need to seek advice from one, and key factors to consider for choosing - https://clrkwlthprtnr.wordpress.com/2025/11/26/why-choosing-the-right-financial-advisors-illinois-matters-for-your-financial-future/. A financial advisor is a qualified expert that aids customers handle their finances and make notified choices that straighten with their life goals

Some Of Clark Wealth Partners

In contrast, commission-based advisors make revenue with the monetary items they market, which might influence their recommendations. Whether it is marriage, separation, the birth of a kid, profession modifications, or the loss of a liked one, these occasions have special economic effects, frequently requiring prompt choices that can have long-term results.